While direct-to-consumer shipping has vastly improved since the Supreme Court ruling, not every state has given the green light and others have imposed various restrictions that ultimately prevent direct shipments.

Direct-to-Consumer Shipping -- Not Quite the Green Light for Every State

This week marks the second anniversary of the Supreme Court’s landmark ruling. Eleanor & Ray Heald assess the changes made since Granholm v. Heald.

by

Eleanor & Ray Heald

May 14, 2007

Grape growing and winemaking have rapidly become attractive business models for family farmers. Today, grapes are the sixth largest crop in the U.S. and, according to latest government statistics, U.S. wine consumers drank 300 million cases of wine in 2006.

According to a recent VinQuest™ U.S. Consumer Direct Wine Sales Report for 2006, total direct sales by U.S. wineries amounted to $2.4 billion and the value of wine shipped directly to U.S. consumers was $1 billion. Wine club sales of $598 million at U.S. wineries was up a whopping 66 percent while $197 million in online sales at U.S. wineries showed a 45 percent gain.

Prior to the Granholm decision, small wineries typically sold a majority of their wine from tasting rooms, but today, in the plurality of states, they are able to reach a larger consumer base outside their state borders. Most newcomers to the wine industry are now able to capitalize on the growing U.S. wine culture in a way that was not possible prior to the Granholm decision.

In his March 28, 2007 Notes on Wine Distribution, R. Corbin Houchins, Esq., of CorbinCounsel.com writes: "Wine distribution law is changing more rapidly and profoundly than at any time since Repeal. Published lists, carrier policies, and regulatory personnel (sometimes from the same agency) disagree on the legality of various means of reaching customers, and regulators change their minds in response to numerous factors of varying transparency. Meanwhile, the economic significance of alternative distribution methods grows."

Jeremy Benson of Benson Marketing, who through Free the Grapes makes consumers aware of direct shipping issues, says "the U.S. Supreme Court Granholm ruling has been a huge boost for consumer choice. Legal direct shipping is now the rule rather than the exception."

ShipCompliant is a leading compliance vendor helping wineries manage the new complexities of interstate direct-to-consumer shipping.

Jeff Carroll, VP of Compliance for ShipCompliant™, explains the realities for wineries using the direct-to-consumer distribution channel in the post Granholm era: "Many people assumed that the Granholm decision would make it easier for wineries to ship directly to consumers. Although we have seen a tremendous growth in the percentage of the U.S. population that is now accessible by wineries for shipping, the reality is that it has become more difficult to comply with the state laws.

Because most of the state statutes contain remnants of the post-Prohibition legislation, the volume limitations, permit process, and reporting requirements are very different from one state to the next. A winery that is shipping to all of the possible states could submit between 400 and 500 state reports (excise, sales, and direct shipping) per year.

“The good news is that in spite of the compliance headaches, we have seen incredible growth in the volume of direct to consumer shipments. The direct channel can be extremely powerful for wineries of all sizes and we therefore expect this growth to continue, especially given the positive trends in wine consumption. Hopefully, we will see more uniformity in the laws from state to state over time."

Benson agrees that despite the challenges, "compliance vendors are helping wineries manage the new complexity and the industry's lobbyists are quietly correcting onerous laws."

Examples of such corrections are:

1) Virginia removed a background check provision in its 2003 law;

2) New Hampshire removed its $237 annual permit fee;

3) Minnesota consumers can now make orders online;

4) Colorado removed its on-site provision.

APPELLATION AMERICA’s online wine store gets a consumer quickly through the direct shipping process in the 34 direct-ship states. Shipping companies such as UPS have helped wineries reduce returns through the shipper's new features such as Address Validation, Email Ship Notification and Voice Notification, which lets consumer purchasers know via an automated voicemail message when wine shipments will be delivered to their residence.

On the other hand, although direct shipping is legal in Florida, 2007 began with an issue that will keep it in the wine news headlines. In December 2006, State Senator Burt L. Saunders (R) prefiled SB 126 which includes the same discriminatory production caps as the bill he sponsored earlier. Proposed legislation excludes shipments from any retailer and prevents wineries from direct shipping if they produce more than 250,000 gallons of wine (approximately 105,000 cases) annually. A bill to this effect was approved unanimously by a Senate committee

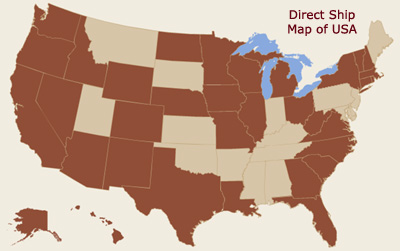

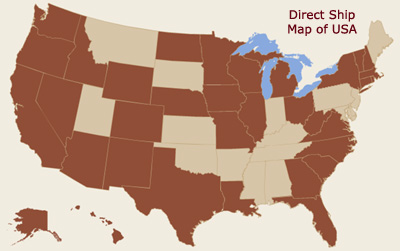

THE DIRECT SHIP SHAPE: States in dark brown are currently available for direct to consumer shipments. States in light brown either prohibit shipments altogether or are not accessible by

common carrier because of complex requirements.

[Map courtesy of Family Winemakers of California] on April 9, 2007. In SB 2282, approved by the Senate Regulated Industries Committee, a consumer would be allowed to receive no more than 12 cases per calendar year from any one winery. Florida HB 1217 does not contain a 250,000 gallon stipulation. With more committee stops in both the Florida House and Senate, bills will have to be reconciled before measures can become law.

Yet, the website for Florida's Division of Alcohol Beverages and Tobacco demonstrates that the 2005 Granholm v. Heald decision has benefited the state's tax coffers. From February 2006, when shipments began, through June 2006, 337 out-of-state wineries registered with the state and paid $52,480 in taxes. During the next comparable five-month period, 468 wineries paid $104,622 in excise taxes to the state.

This is but one proof that consumers are responding to direct shipping as a way to purchase wine and that state tax revenues are benefiting. If Senator Saunder's bill becomes law, it will not only significantly deteriorate Florida's business and consumer environment for wine but will also hamper two large Florida charity wine auctions: Florida Winefest and Auction in Sarasota and the Naples Winter Wine Festival, which in 2007 set an American record for charity auctions by raising $16.5 million. Currently, both auctions receive wine shipped to the state as winery donations. On the Florida issues, there's just one applicable phrase, stay tuned.

According to a recent VinQuest™ U.S. Consumer Direct Wine Sales Report for 2006, total direct sales by U.S. wineries amounted to $2.4 billion and the value of wine shipped directly to U.S. consumers was $1 billion. Wine club sales of $598 million at U.S. wineries was up a whopping 66 percent while $197 million in online sales at U.S. wineries showed a 45 percent gain.

Prior to the Granholm decision, small wineries typically sold a majority of their wine from tasting rooms, but today, in the plurality of states, they are able to reach a larger consumer base outside their state borders. Most newcomers to the wine industry are now able to capitalize on the growing U.S. wine culture in a way that was not possible prior to the Granholm decision.

In his March 28, 2007 Notes on Wine Distribution, R. Corbin Houchins, Esq., of CorbinCounsel.com writes: "Wine distribution law is changing more rapidly and profoundly than at any time since Repeal. Published lists, carrier policies, and regulatory personnel (sometimes from the same agency) disagree on the legality of various means of reaching customers, and regulators change their minds in response to numerous factors of varying transparency. Meanwhile, the economic significance of alternative distribution methods grows."

Jeremy Benson of Benson Marketing, who through Free the Grapes makes consumers aware of direct shipping issues, says "the U.S. Supreme Court Granholm ruling has been a huge boost for consumer choice. Legal direct shipping is now the rule rather than the exception."

Compliance Burdens

"But, for wineries," Benson notes, "there has certainly been some short-term pain as burdensome legislation is producing time-consuming compliance requirements."

ShipCompliant is a leading compliance vendor helping wineries manage the new complexities of interstate direct-to-consumer shipping.

“The good news is that in spite of the compliance headaches, we have seen incredible growth in the volume of direct to consumer shipments. The direct channel can be extremely powerful for wineries of all sizes and we therefore expect this growth to continue, especially given the positive trends in wine consumption. Hopefully, we will see more uniformity in the laws from state to state over time."

Benson agrees that despite the challenges, "compliance vendors are helping wineries manage the new complexity and the industry's lobbyists are quietly correcting onerous laws."

Examples of such corrections are:

1) Virginia removed a background check provision in its 2003 law;

2) New Hampshire removed its $237 annual permit fee;

3) Minnesota consumers can now make orders online;

4) Colorado removed its on-site provision.

APPELLATION AMERICA’s online wine store gets a consumer quickly through the direct shipping process in the 34 direct-ship states. Shipping companies such as UPS have helped wineries reduce returns through the shipper's new features such as Address Validation, Email Ship Notification and Voice Notification, which lets consumer purchasers know via an automated voicemail message when wine shipments will be delivered to their residence.

On the other hand, although direct shipping is legal in Florida, 2007 began with an issue that will keep it in the wine news headlines. In December 2006, State Senator Burt L. Saunders (R) prefiled SB 126 which includes the same discriminatory production caps as the bill he sponsored earlier. Proposed legislation excludes shipments from any retailer and prevents wineries from direct shipping if they produce more than 250,000 gallons of wine (approximately 105,000 cases) annually. A bill to this effect was approved unanimously by a Senate committee

THE DIRECT SHIP SHAPE: States in dark brown are currently available for direct to consumer shipments. States in light brown either prohibit shipments altogether or are not accessible by

common carrier because of complex requirements.

[Map courtesy of Family Winemakers of California]

Yet, the website for Florida's Division of Alcohol Beverages and Tobacco demonstrates that the 2005 Granholm v. Heald decision has benefited the state's tax coffers. From February 2006, when shipments began, through June 2006, 337 out-of-state wineries registered with the state and paid $52,480 in taxes. During the next comparable five-month period, 468 wineries paid $104,622 in excise taxes to the state.

This is but one proof that consumers are responding to direct shipping as a way to purchase wine and that state tax revenues are benefiting. If Senator Saunder's bill becomes law, it will not only significantly deteriorate Florida's business and consumer environment for wine but will also hamper two large Florida charity wine auctions: Florida Winefest and Auction in Sarasota and the Naples Winter Wine Festival, which in 2007 set an American record for charity auctions by raising $16.5 million. Currently, both auctions receive wine shipped to the state as winery donations. On the Florida issues, there's just one applicable phrase, stay tuned.

READER FEEDBACK: To post your comments on this story,

READER FEEDBACK: To post your comments on this story,