While there have been dramatic improvements in direct-to-consumer wine sales laws since the Supreme Court ruling in its favor, there are still states with restrictive laws.

Granholm v. Heald 3 Years Later

Notes on the current state of direct-to-consumer shipping

May 16, 2008 marked the third anniversary of the U.S Supreme Court decision in the case of Granholm v. Heald. Wine Institute figures show that 36 of the 50 states now have some form of direct shipping.

by

Eleanor & Ray Heald

May 29, 2008

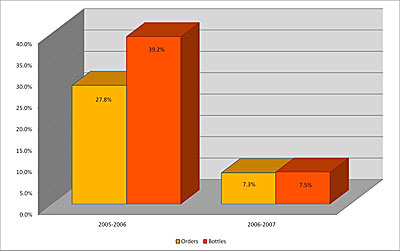

ased on 1.2 million orders for 5.0 million bottles shipped, the U.S. wine industry experienced $30+ billion in sales in 2007. Yet, the growth rate of the industry decreased from 6.9 percent in 2006 to 4.0 percent in 2007. The data highlighted a direct-to-consumer (DTC) sales growth of 27.8 percent in 2005-2006, slowing to 7.3 percent in 2006-2007.

ased on 1.2 million orders for 5.0 million bottles shipped, the U.S. wine industry experienced $30+ billion in sales in 2007. Yet, the growth rate of the industry decreased from 6.9 percent in 2006 to 4.0 percent in 2007. The data highlighted a direct-to-consumer (DTC) sales growth of 27.8 percent in 2005-2006, slowing to 7.3 percent in 2006-2007.

A depressed U.S. economy was implicated as the cause for decreased growth in wine sales. However, we add that, with the increase in new wineries in many states, consumers are

While direct to consumer wine sales exploded between 2005 and 2006, the growth rate dropped in the following year. Yellow bars represent DTC orders, orange bars equal bottles sold.

Table courtesy of Stonebridge Research LLC

Although California DTC sales growth declined from 52.2 to 40.9 percent in 2005-2007, New York, Florida, Virginia and Ohio have seen increased DTC sales. We should qualify that by saying that those states essentially started from zero, so any increase is large in comparison.

Tasting rooms account for a whopping 49 percent of winery direct sales. This figure includes tasting room sales but also DTC sales following a tasting room visit. Consumers also tend to purchase wines from wineries they have visited at retail outlets and restaurants, but that’s difficult to track.

What California Wineries Say

Although the following producers fall into the New Vine Logistics data, their reports present a positive position at this juncture and moving forward.Winemaker Richard Arrowood (Arrowood Vineyards & Winery, Sonoma Valley, Calif.) sells 30 percent of his production direct to consumer. At his newly-opened winery, Amapola Creek, also in the Sonoma Valley AVA, Arrowood plans to sell his entire production, which will eventually max out at 3,000 cases, DTC.

Lesley Russell, VP of Direct Marketing and Sales at St. Supéry Vineyards, Rutherford, Calif., reports, “Since the Heald decision (it’s technically referenced as the Granholm decision,

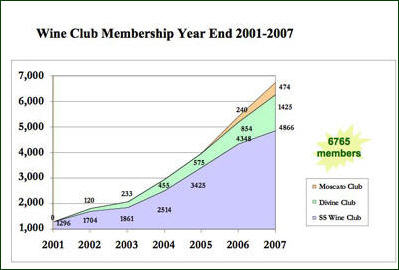

The table shows the continued growth of St. Supéry Wine Club membership from 2001-2007, subdivided by the particular membership program subscriptions. See Fig. 2 for more St. Supery sales data.

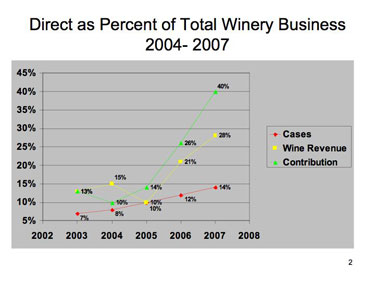

Russell detailed statistics further: Total wine club membership is 6,765 and has grown from 4,000 in 2005, a growth of 69 percent. The total number of cases sold DTC increased from 10 percent to 14 percent between May 2005 and the end of 2007. Total DTC wine revenue escalated from 10 percent to 28 percent in the same period.

According to Joe Antonini, Chairman of Andretti Winery, Napa, Calif., “We have increased our DTC shipping by 88 percent from May 2005 to May 2007.”

Partner Pat Roney explains, “Windsor Vineyards, Windsor, Calif., sells 100 percent direct to consumer. Since the change in shipping laws, we have seen an 11 percent increase in business. However, we were already shipping to many of these states through three-tier relationships.”

Wineries Outside California Share Data

Black Star Farms, a winery focused on agritourism in Suttons Bay, Mich., in the Leelanau Peninsula AVA, reports both success and irritation. Managing Partner Don Coe says, “Black Star Farms does more DTC business than any other Michigan winery. Our wine club has 300 members with an elevated sense of awareness about DTC wine shipping because the law suit was initiated in Michigan.“Our DTC sales account for five to six percent of total sales and our DTC shipping increased 97 percent from 2005 to 2006 and an additional 50 percent

Fig. 2: Direct sales to consumer play an increasingly significant part of St. Supery’s overall sales revenue.

Proprietor/winemaker Jim Lester, Wyncroft Winery, Buchanan, Mich., says, “I have shipped to California, Illinois, D.C., Georgia, Ohio and Colorado so far. Not much of a percentage yet as we have so little wine and it all sells out in our own back yard. But the fact that the opportunity exists is very important to our national reputation and our ability to ship where no distributor would consider taking on our label.”

Wines and Vines reports that Illinois has approved DTC wine shipments from both out-of-state and local wineries beginning June 1, 2008. Wineries holding an Illinois Winery Shipper's License ($150 to $1,000 based on production) may ship up to 12 cases of wine annually to adult residents. The law also permits wineries producing under 25,000 gallons per year (10,500 cases) to self-distribute up to 2,100 cases to Illinois retailers. Over 95 percent of Illinois wineries are below this production threshold.

Paul Hahn, new president of the Illinois Wine and Grape Growers Association (IWGGA) and owner of Mackinaw Valley Vineyard in Mackinaw, Ill., said he's able to sell about

90 percent of his 2,500 annual case production DTC at the winery. New regulations will be helpful to most of Illinois' 76 producers. The Illinois grape and wine industry contributes an estimated economic impact exceeding $250 million annually, according to the Illinois Liquor Control Commission (ILCC).

90 percent of his 2,500 annual case production DTC at the winery. New regulations will be helpful to most of Illinois' 76 producers. The Illinois grape and wine industry contributes an estimated economic impact exceeding $250 million annually, according to the Illinois Liquor Control Commission (ILCC).

The Beat Goes On

To quote the ShipCompliantBlog, “Georgia is a Go.” A distinctly tortuous law was replaced by a permit bill signed by Governor Sonny Perdue and goes into

Even with a Supreme Court ruling in DTC favor, Freethegrapes.org is still waging battles with distributor-influenced states.

READER FEEDBACK: To post your comments on this story,

READER FEEDBACK: To post your comments on this story,